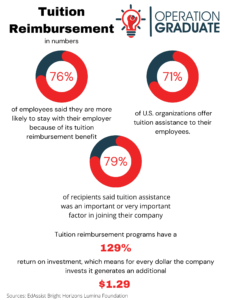

Offering a small business tuition reimbursement program for employees is becoming increasingly popular among employers. When job searching, there are a number of things that candidates look for, ranging from salary to benefits. In today’s growing job market, it is not enough to offer great pay. Educational reimbursement benefits are becoming a staple requirement to many people’s job search. According to EdAssist, 71% of U.S. organizations offer their employees tuition reimbursement. For example, Apple, Chipotle, Chick-fil-A, and Best Buy are just some of the companies that currently offer tuition reimbursement as a benefit for its employees. However, this benefit is not reserved for large corporations only–small businesses can also experience the benefits of implementing a tuition reimbursement program.

When considering whether your company should offer employee tuition reimbursement, it is important to be knowledgeable about the topic in order to maximize benefits for both you and your employees. Here is the ultimate guide to starting, designing, and maintaining a tuition reimbursement program for small businesses.

What is tuition reimbursement?

According to Northeastern University, tuition reimbursement is “an employee benefit through which an employer pays for a predetermined amount of continuing education credits or college coursework to be applied toward a degree.” It is a great way for employees to support themselves while completing their college degree. Although fairly simple to define, there are many different ways in which employers can offer this benefit. For example, some employers will assist with tuition costs of non-accredited courses that don’t lead to a graduate or undergraduate degree. Other employers will pay for tuition for certificate training courses and even cover the cost of books and supplies.

Why do employers offer tuition reimbursement?

Tuition reimbursement programs don’t only benefit the employee. In fact, there are a number of reasons why more and more employers are beginning to offer this benefit.

-

Help attract and retain top talent

Studies show that 76% of employees said they are more likely to stay with their employer because of its tuition reimbursement benefit. Employees who feel like their job is contributing to their personal success and professional development are far more likely to remain at a job, reducing your company’s turnover rate. Offering a well-rounded set of benefits including educational benefits creates engaged, loyal employees who will actually want to work.

-

Talent development

Giving employees a tuition reimbursement incentive will encourage them to further their education. This will ultimately make your employee base more educated. Whatever skills they will learn from higher education, they are likely to bring to the job as well. In the end, a more educated and skilled employee base will increase productivity and bring more success to your company.

-

It’s tax exempt

Reimbursing your employees for tuition doesn’t have to be costly. Due to section 127 of the IRS tax code, employers can give employees up to $5,250 per employee per year in tuition reimbursement without being taxed. Under this section, a written tuition reimbursement policy will qualify as tax-free employer-provided assistance.

-

Boost employee engagement

When employees feel valued in a job, statistics show that they are much more likely to produce high quality work. Implementing a tuition reimbursement program creates satisfaction in the workplace and in employees, which builds an esteemed reputation for your small business and shows your employees that you value their work.

-

Create a stronger company

Encouraging employees to achieve their educational goals and enroll in higher education institutions simply creates a more educated workforce. Tuition reimbursement programs also show that you, as an employer, are invested in advancing your employees’ careers and professional development. This will be enticing for high-value potential employees during their job search.

How does tuition reimbursement work?

As mentioned, there are a few different ways tuition assistance can be provided to employees. How you develop your tuition reimbursement program will be based upon a few factors, such as program expenses and how many employees are expected to use the program. Secondly, some tuition reimbursement programs may only apply to job-specific certificate or training programs. Typically, small businesses will only pay for an employee to take courses that are directly related to an employee’s current occupation. However, this is not the only option. Employers may reimburse tuition costs for any field of study–it all depends on the employer’s unique policy. Furthermore, an employer may require that employees must maintain a certain GPA in order to qualify for tuition reimbursement. Some employers also require employees to remain in the company for a certain period of time after completing a degree or certification. Or, an employee may have to complete their coursework within a given timeframe. There are a handful of factors that can go into a tuition reimbursement program. Working out these details is your responsibility as an employer.

Tuition Reimbursement FAQ’s

Does tuition reimbursement work with financial aid?

Receiving tuition reimbursement will not disqualify your employees from receiving financial aid or taking out student loans. Your employees will have to disclose how much money they are receiving in tuition reimbursement in their Financial Aid application, which may affect the amount of aid they receive. However, tuition reimbursement can be used in combination with financial aid.

Is tuition reimbursement taxable?

It depends. Despite how it may seem, company tuition reimbursement programs can cost very little for employers to offer. This is because of section 127 of the Internal Revenue Codes, which allows employers to offer up to $5,250, per employee, of tuition reimbursement annually without being taxed. Under this section, a written tuition reimbursement policy will qualify as tax-free employer-provided assistance. There are a few important requirements to a well-designed tuition reimbursement program that must be followed in order to remain tax-free. However, if you reimburse more than $5,250 per employee per year, you will have to pay taxes on it. It is best practice to speak to a tax expert when designing this aspect of your business’ tuition reimbursement program.

Should I offer my employees tuition reimbursement?

Again, it depends. Generally speaking, there are far more pros to offering a tuition reimbursement program than cons. Although it can be extremely inexpensive, some small businesses do not have it in their budget to offer tuition reimbursement. However, studies show that tuition reimbursement can have a positive impact on the success of business as a whole. For example, if your business is having issues with employee retention, tuition reimbursement should be taken into consideration, as it is a very effective way to attract and retain employees. It is a good rule of thumb to evaluate your business strategy to determine whether you should implement a tuition reimbursement policy.

Things to consider when creating a tuition reimbursement program

There are a few important things to consider before developing a tuition reimbursement policy. Here are some common things to consider when developing your tuition reimbursement program:

- Who will be eligible?

Consider who and how many of your employees will be eligible to receive tuition reimbursement benefits. You may only allow full-time employees to be eligible, or employees that have exceeded 90 days of employment.

- How much in tuition reimbursement will you offer?

Determine how much money your program covers. Remember, if you want to remain tax-free, you can only offer $5,250 per employee per year. Will you decide to offer more?

- What are your business’ budget limitations?

Depending on how much you decide to reimburse your employees, you could be allotting a significant percentage of your business’ budget to pay for tuition reimbursement costs. Review your budget to decide how much of it will be dedicated to offering this benefit to your employees.

- Will you require specific course or school requirements?

What courses will your employees be able to take? As mentioned previously, some employers will require their employees to take certain courses in order to be eligible for tuition reimbursement. Similarly, what schools will your employees be able to attend to receive tuition reimbursement?

What are the requirements for a tuition reimbursement program?

There are a few very important requirements in order for a qualified tuition assistance program to be successful. Within these programs, “education assistance” is defined as an employer paying for education expenses on behalf of an employee, or an employer allocating education to an employee. However, employer-provided education benefit programs do not include the payment of tools/supplies (other than textbooks), meals, lodging, transportation, etc. All education assistance programs must be provided to employees under a written plan, and must meet certain legal requirements, such as a non-discrimination policy. Work with a legal team to ensure that all legal requirements of your small business’ tuition reimbursement policy are being met.

What companies offer tuition assistance for their employees?

Thousands of companies offer tuition reimbursement for their employees, including small businesses. The benefits for employers apply to companies of all sizes, but here are some of the biggest:

- Apple

- Amazon

- Chik-fil-A

- Best Buy

- Chipotle

- FedEx

- and more.

How to set up a tuition reimbursement program

Your HR department will play an integral role in the entire process of designing and implementing your program. To set up a well-functioning program, carefully consider all of the variables listed above. Decide on your budget, timing, course/timeline requirements, eligibility, etc. Additionally, it is important to establish a clear line of communication with your employees to ensure that they understand the exact benefits they are receiving. After launching your tuition reimbursement program, assess how it is being received by your employees. Review the changes in your business as a whole after a certain period of time after your program has been implemented. This will give you a clear picture of how your new benefit is impacting your business. From there, you can adjust your tuition reimbursement policy with your HR team accordingly.

Conclusion

Overall, having a tuition reimbursement policy available for your employees is an extremely valuable asset. Many businesses have found success with retaining educated employees and strengthening their company after implementing a tuition reimbursement program. Although the process of designing and implementing the program may be time-consuming, it is worthwhile and the positive effects it can have on your small business can be huge. Consider joining the thousands of businesses offering this benefit.

Ready to get started? Book a call with us today!

Sources:

Bright Horizons 2019 Worker Learning Index

Lumina Foundation The Case for Talent Investment

Scholarship America: The Benefit that Boosts Retention